Smoking Volatility

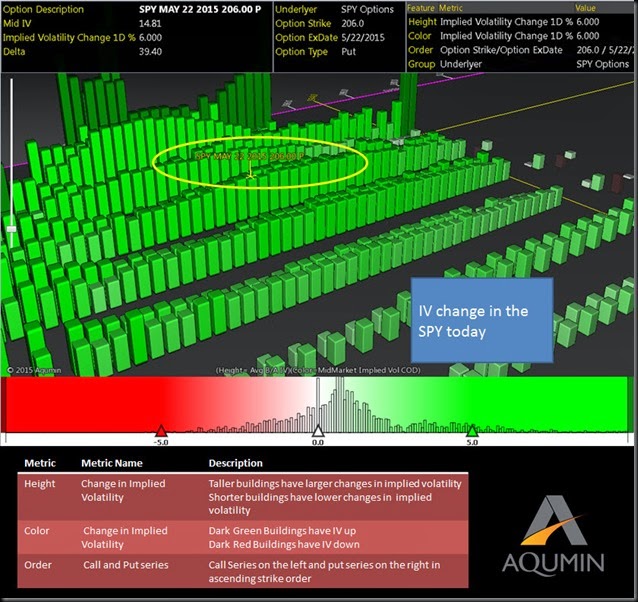

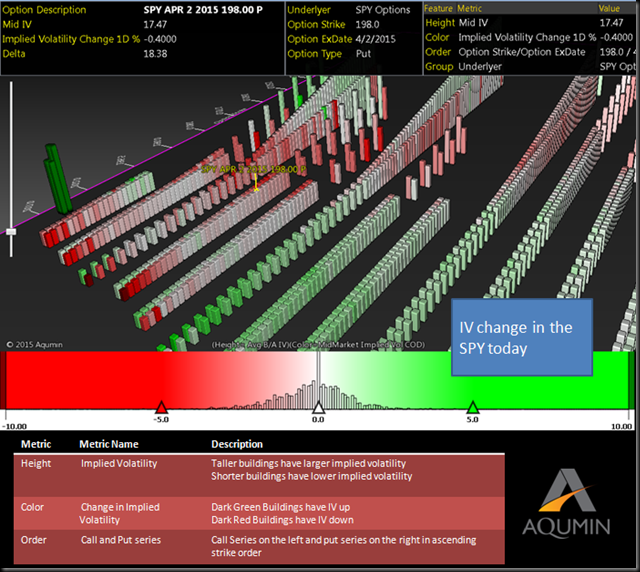

As Friday rolls to a close stocks have seen some near record levels of volatility. If the VIX could have opened early Monday morning we would have touched 80% on that crazy downward spike. Notice there is no Financial Crisis currently. The funny thing is that was almost cheap. Traders know that when things get out of hand the most valuable commodity is gamma. Having some would have helped a whole lot on Monday.

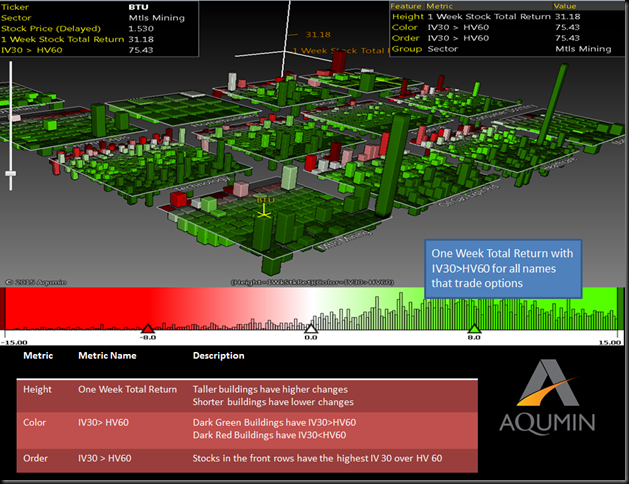

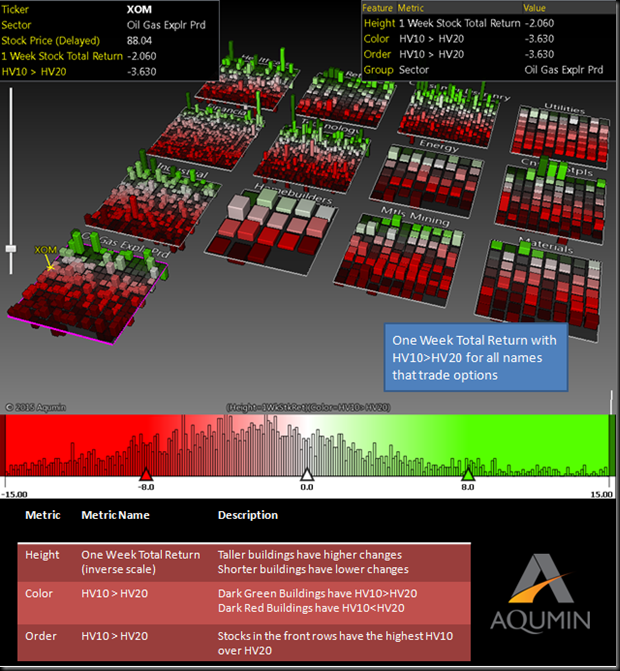

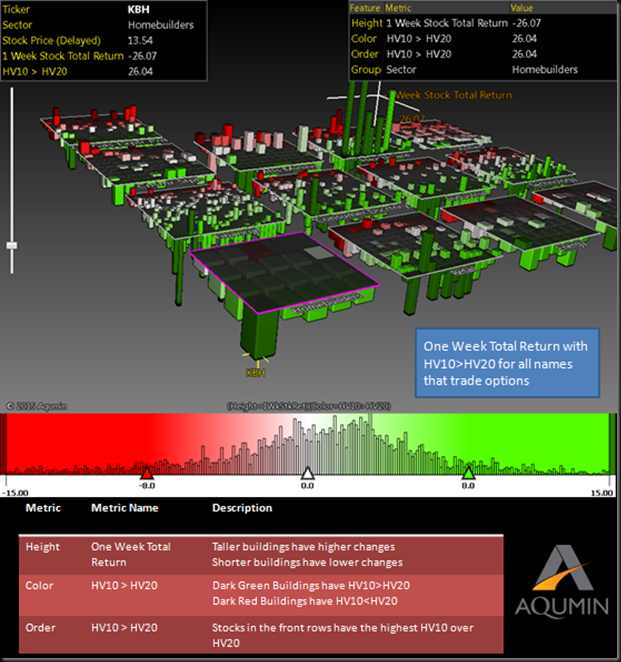

On a volatile week the Metals and Mining groups showed the highest IV. Note that in the OptionVision™ Implied Volatility (IV) landscape, Mtls and Mining show the highest average IV over the 60 day realized volatility. The meltdown in China basically left that segment in tatters and it only is just recovering or trying to. The IV still remains high as the future is totally murky. This sets up more potential movement than normal.

When IV is this much of a premium over realized volatility that usually means the market has imploded, yet we are back to the levels we were at on Friday for SPX. The ground is still very shaky. If anything at this point I would still buy Gamma near the money and sell some Vega out of the money, We could buy ratio call spreads (buy 2 sell 1) with the long calls near the money. Any positive ratio that brings a credit in the some of the Mtl/Miners seems reasonable. If the recovery continues they should pay. BTU has been in the news recently and would not make a bad candidate for this kind of move. Other miners look ok in the space and might do as well if Coal looks too scary,

OptionVision™ – data from ORATS

Read more from Andrew at Option Pit