Vol buyers looking toward NFP

It is possible we are back to the days when the NFP numbers mean something. Stocks are more edgy lately as the intraday volatility picks up. The 16 VIX right now is justified on the touchy moves over the last 4 or 5 sessions. The bid for volatility today belies something else.

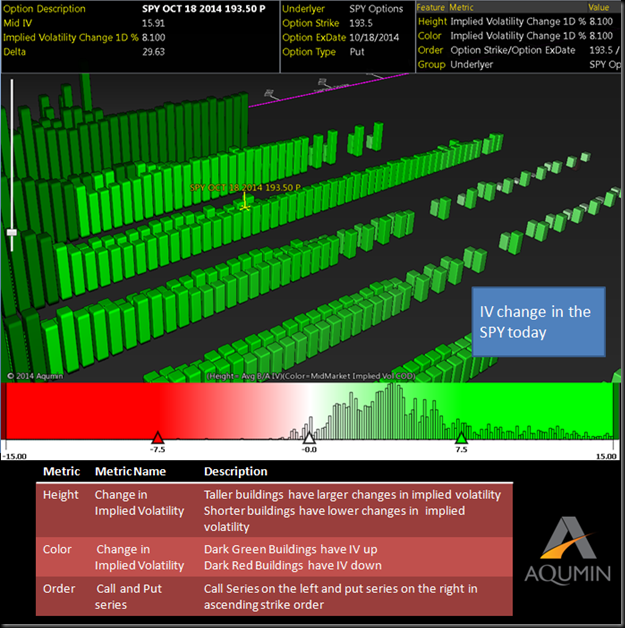

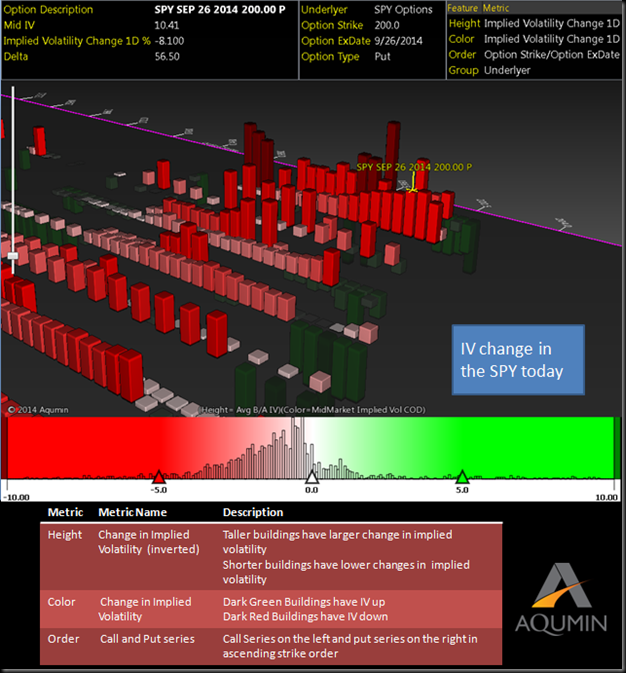

Note on my snap from OptionVision™ today the way IV is up in the SPY. There is some weekend effect in the options from the day reset but note how smooth the change in IV was. Volatility did not jump too much in the OTM option relative to the ATM options. What this says is that traders think IV should be higher all up and down the curve.

IV is telling us the market is going to move. The VIX futures kept up a healthy gain today and are following the change in the VIX cash closely. Normally if the spike in IV is viewed as short lived, the futures will lag the cash VIX by a substantial amount. That is not the case today. The even move in IV all up and down the curve is telling us that.

This payroll number will come and go but will the volatility remain? Stay tuned for Friday afternoon but I think the bid for IV does not last past Friday. I like the idea of flat delta iron condor in SPX or RUT. If worried about a sustained selloff after the NFP, hedge with cheap 4-5 point wide butterflies in the VIX Oct cycle with the Iron Condors.

OptionVision™ – data from ORATS

Read more from Andrew at Option Pit