The Fed Speaks

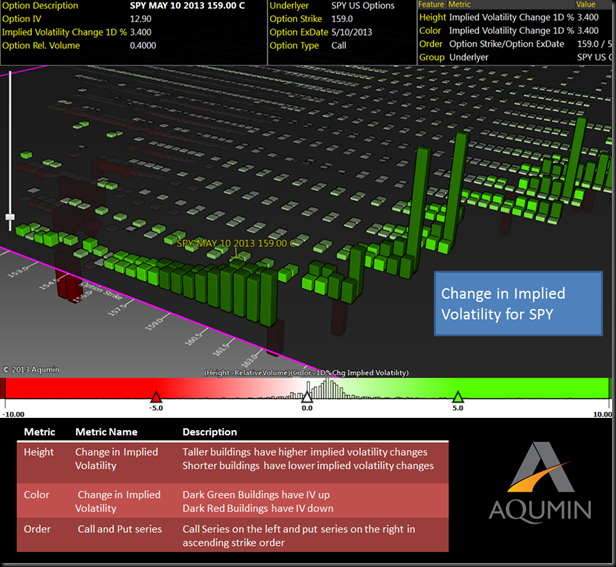

Ben Bernanke testified before Congress yesterday and said things were not too bad but could be better. He thought that both sides getting together to simplify the tax code would be great. One can still hope. The bigger news is that the Fed could stop buying bonds if the job outlook improves so they are waiting. Waiting generally means movement should slow down. No real surprise there since that is what they have said for a while. The market liked it in the morning and did not like it in the afternoon as 3 weeks of buying came to an end. Add a slowdown in China and we are down ¾% in the morning. I am using OptionVision™ to look at how the bonds, via the TLT, reacted to the Fed news by the close yesterday.

By the end of the day the market had bid up the volatility in the TLT pretty solidly. Notice that some of the upside caught an extra bid. The mid-June ATM IV in the TLT is around 14% which is right at 6 month highs. Today’s downdraft might make TLT interesting again but after beating around for the morning session bonds did not move much, so the flight to quality action is dimmed. That is usually a sign the IV should start to drift back to lower levels. I think a controlled short premium trade, Iron Condor type, in the July cycle would work and close when the IV gets to 11.5%. The Fed said they are waiting for jobs data which means bonds should keep going sideways in a range for a while.

OptionVision™ – data from ORATS

Read more from Andrew at Option Pit