The Skew climbs the wall of worry

Thursday was another record for the SPY. If you listen to the folks on TV, each person on camera is trying to pick a top or look for another reason for the market to crack. That well may be as some kind of selloff is inevitable. This morning the market looks about down .5% so maybe the pundits will have their day. Looking at the trade on the close yesterday I saw a slight change in the SPY skew. That is telling a different story.

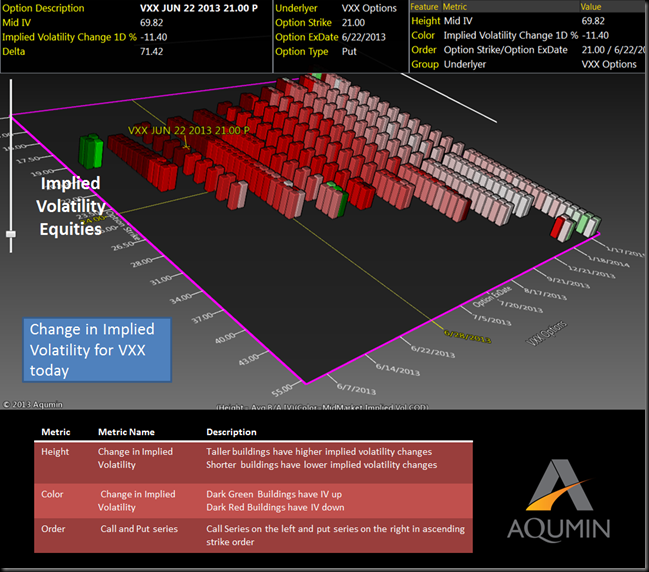

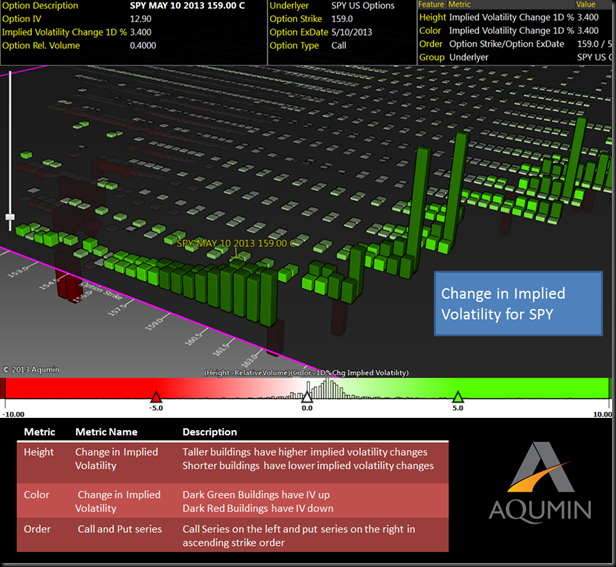

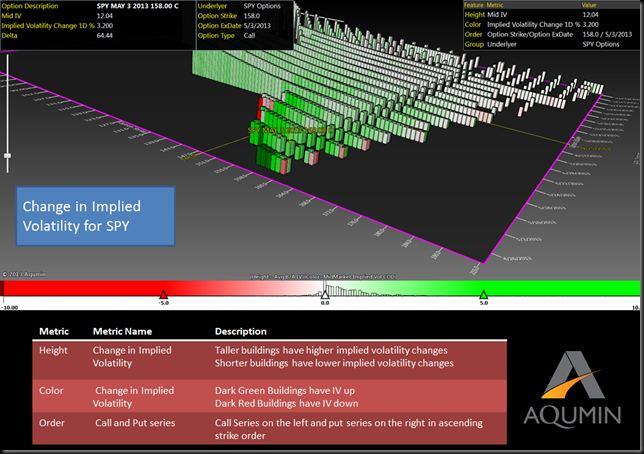

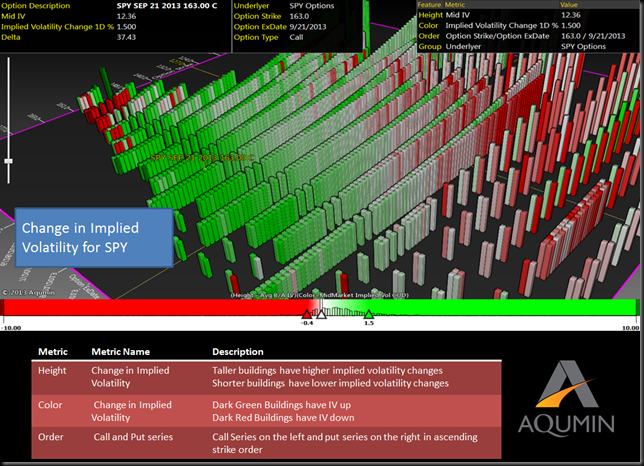

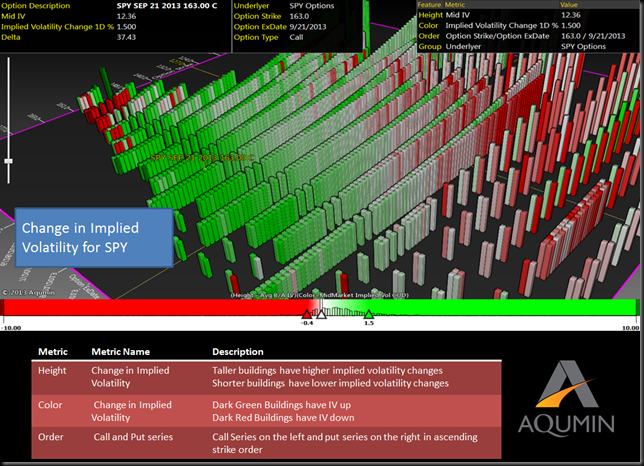

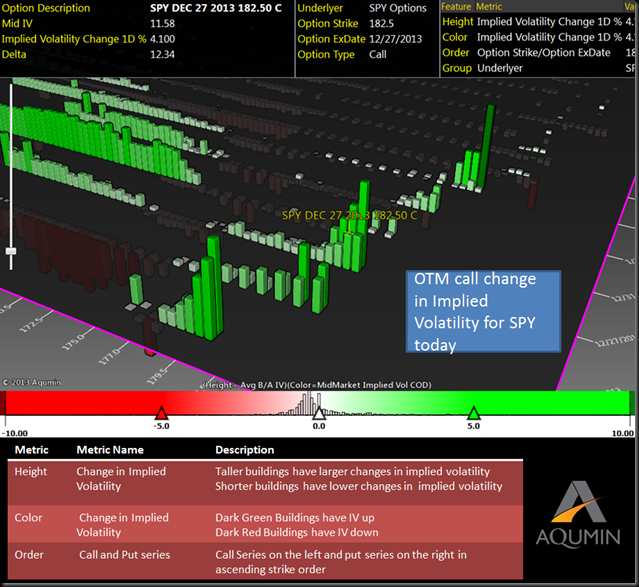

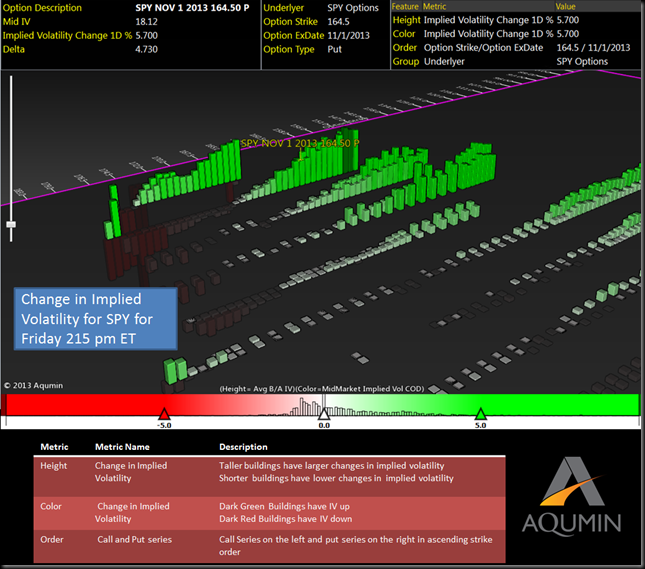

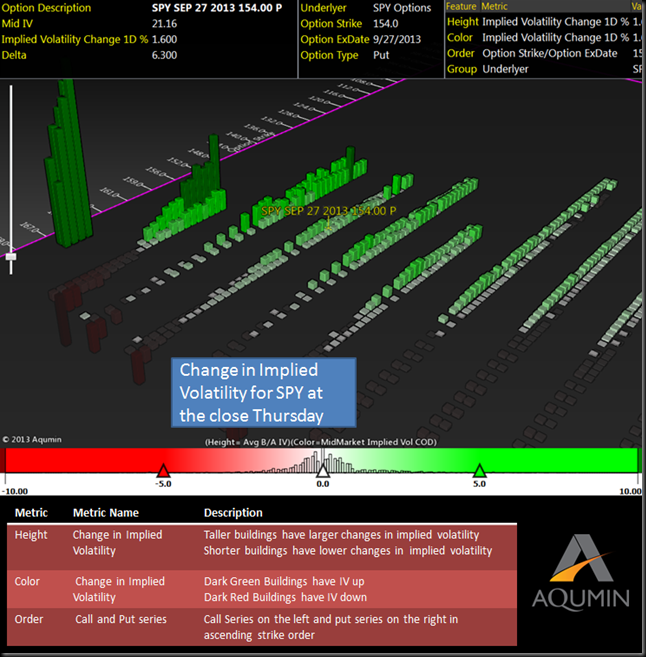

What we are looking at with OptionVision™ is a landscape of all the option chains in the SPY with the columns that are months. The curve for volatility is the height of each little building. Color is for implied volatility change (Green up/Red Down). Yesterday in what seems like a week of rallying, where were the changes in volatility located? The OTM call strikes are in the lower left of the landscape. The IV was climbing there. Note the red declines in IV on the downside puts in the outer months. This is the skew in the index giving way. The CBOE Skew index notched a recent low yesterday.

What I found more interesting was the lift (albeit small) of the OTM call implied volatility. This means one of two things:

1. Paper is not selling upside anymore and the liquidity providers are flattening the upside.

2. Paper is buying OTM calls.

I think it is a little of each. As an ex-SPX trader, flattening upside usually came with more of a rally as I wanted to get ahead of the buying. The problem with 9% call volatility is that there are less call sellers. If there is some on-balance upside buying that is a good sign our rally is going to keep going. At least short term we have a floor in the index implied volatility and might actually see it increase if we get more of the same action. With this potential I like the idea of ratio calls spreads (buy 2 sell 1) 6 weeks in duration or more using OTM calls with a 3 week hold maximum. If the pundits are right you keep the small credit and if this liquidity fueled rally keeps pumping the upside skew and the index the trade will do just fine.

To see the end of day skew change, surf over to the CBOE’s website below and check out the curve shift in the VIX, SPX, OEX and DJX.

www.cboe.com/CBOE3D

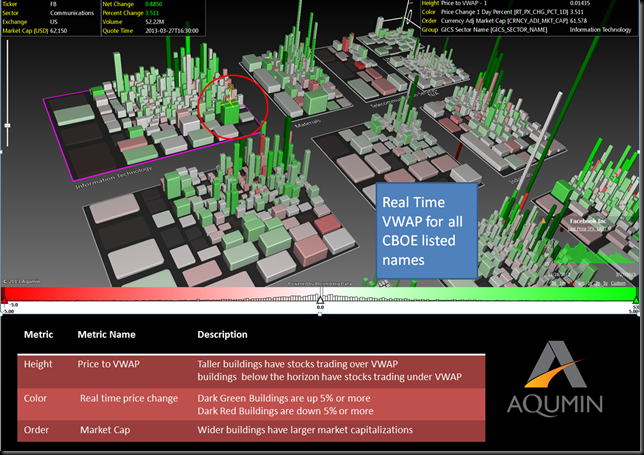

CBOE 3DTM

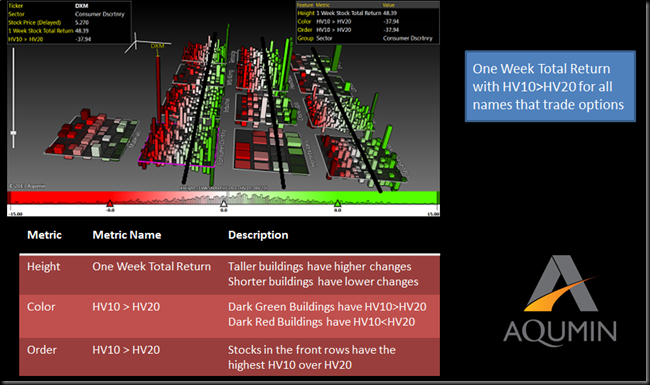

The Options Institute at CBOE is partnering with Aqumin and ORATS to bring you CBOE 3D using OptionVision™ technology to display proprietary Option Data provided by ORATS. By offering you an end of day "snapshot" of the day's biggest index moves, you are "getting the whole picture on market activity at a glance. Using 3D visualization, you will get daily implied volatility reports by series and expiration on SPX, OEX, DJX and VIX with data provided by ORATS. All reports are available to you for download in a pdf format.

CBOE 3D Daily Volatility Activity Reports:

OptionVision™ – data from ORATS

Read more from Andrew at Option Pit

OptionVision

OptionVision OptionVision

OptionVision