Buying the big move

The last post of 2012 is a little bitter sweet. Overall a good year for equity returns but I can’t shake the feeling that we missed something and the market is holding back. Most of the big issues of 2012 are not on the front page anymore. Much like the end of 2011, a few loose ends are hanging around. One thing I find telling is that the bond prices (measuring by the TLT) did not continue their move to outpace equities. The Fed is going to keep buying but that rally looks like it is coming to an end. The most crowded trade of 2012 is ending up around nowhere as I have TLT up around 1% YTD before dividends. Here is my last snap of equity volatility going into 2013.

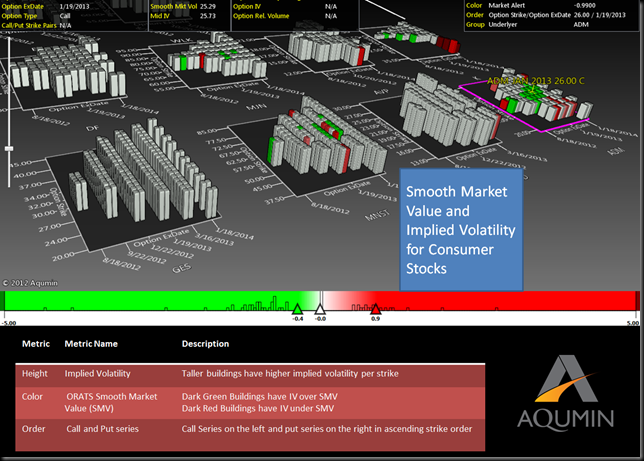

This was the snap for Thursday afternoon in OptionVision™. Note the green bulge in higher implied volatility around the 3rd-5th weeks in the SPY. The two near terms months were expiring on Dec 28th and Dec 31st (today) were red signaling no real movement until after today. The market was and is still hungry for short term options but only after the deadline. That is how tight things are handicapped right now. We are at the strange place where the market is not moving much now but is expecting a big move in the not too distant future. Volatility players are betting that the result of the Fiscal Cliff talks will see a big move. I don’t disagree with them.

There is a trader saying that ‘volatility begets volatility’. In this case the market is so focused on short term options that I think a large move is inevitable. For me the best play there is to buy the 1st out of the money strangles (closest to the at the money) in options with 2 weeks or less to expiration and then, here is the hard part - hold them. If 2013 starts like 2012 did, implied volatility should move lower but the market sharply higher. The gamma will pay for the volatility drop. The strangle should give you the choice just in case the politicians do not take this opportunity to save us at the last minute.

OptionVision™ – data from ORATS

Read more from Andrew at Option Pit