Short history-

Market data has been around as long as there has been a market. The Egyptians were using wet clay blocks to quote wheat future prices thousands of years ago. The big uptick in disseminated market quotes was the printed newspaper as soon as they invented the printing press. You could read about your daily tulip bulb prices in the Dutch Gazette in the early 1600’s. Things pretty much stayed that way until the telegraph and the advent of the electronic ticker in the 1800’s. From the outside investors’ point of view this was really the first access to the market intraday and “reading the tape” became part of the investing lexicon. Television screens came along in the guise of the Quotron terminal and now market data had a blinky, real time feel. That Quotron was still around on exchange floors until 2000 or so even when the PC (real time quotes, charts and spreadsheets) had near completely taken over for trading screens. While the markets change very fast, you will notice how slow quoted market technology changes.

Market Data Structure-

What has changed very fast over the last 20 years or so is speed of access to exchange ticker plants. It was not the quote per se but the access to it. The electronic pipes are there for everyone but some data infrastructures are bigger than others and that gives a microsecond lead in getting a quote. The Algo (programmed, automatic execution) and High Frequency Traders (HFT) now drive a large part of that order flow. And there is a continued race for speed which I will assume will end when all HFT’s can receive quotes at the speed of light. It will go back to being better instead of just faster. The problem with all of this technology is that the exchange liquidity has become fractured. As a result, we see more volatility and less concentrated liquidity except in a few markets. If market data tools are going to evolve they have to quote more information than just an uptick or a downtick.

Besides speed to market, the biggest evolution in the last 10 years is the proliferation of indexes and ETF’s and ETN’S. In general, these securities pull together like instruments to make market access easier for the trading public. The flip side of course is the markets will start to move closer together because the ETF managers have to buy and sell like securities in bulk to keep up with demand for their products. You want to trade the S&P 500? There are probably 2 dozen+ different ways to go about it- long, short, leverage, inverse leverage, you name it. The reality is that there are only the 500 names and product demand makes them mover ever closer together. If you want to find an edge, you want to see what is not moving with the market these days. Traders need their quotes to tell them more than position, they need relative position.

What is a 3d market quote?

With the advent of the various market factors of speed, fractured liquidity and increasing correlations the idea of a market quote in context makes more sense. These factors have always been in play over the last 20 years to some degree but now, as they act together, the impact feels greater in an upswing in market volatility. What is the context of a move in an individual name with the swirl of market forces around it? What is a 3D market quote?

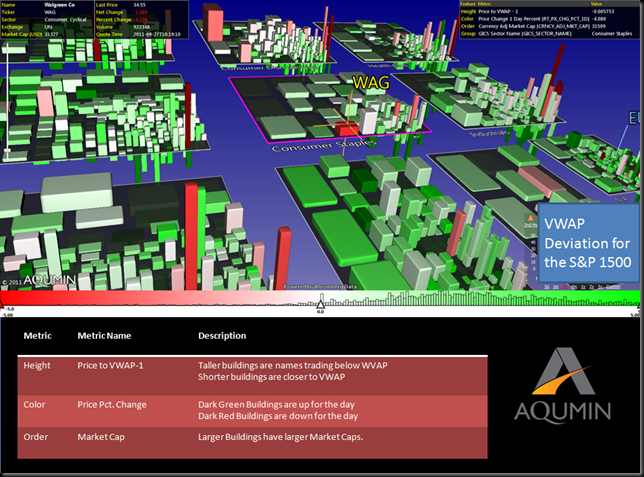

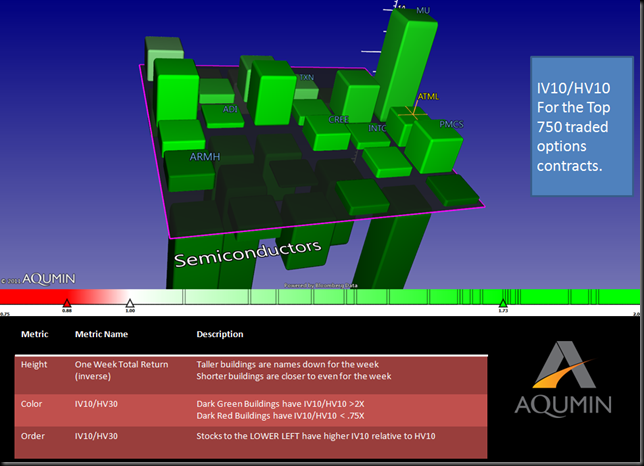

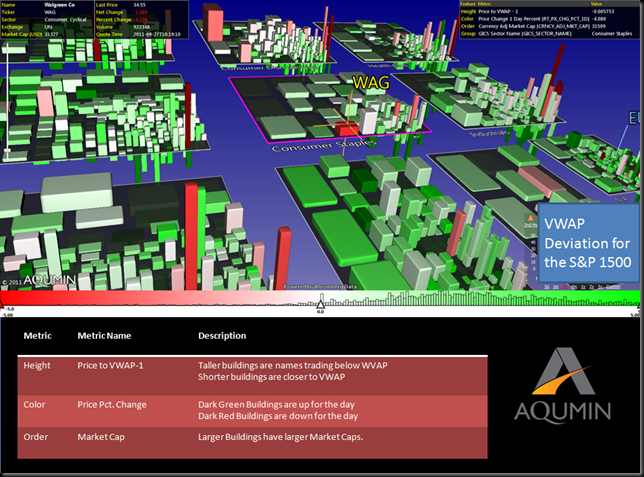

First to describe a 3D market quote you need to understand what that represents. Below is an Aqumin Landscape using Bloomberg Data (any data point in Bloomberg is available to configure the space) to describe several real time market data points acting at once. Obviously you notice the “city blocks” with the “buildings” in each block. Each block is a user defined grouping like a GICS Sector and each building is a security which in this case is an equity or ETF. The next thing you notice is the Heads Up Display (HUD) to convey the actual market quote in the black boxes on top of the Landscape. The next, new landscape features are building colors, heights, sizes and positions. These landscape functions provide the relative relationships of the quoted data within the entire market place. You can pan, zoom and rotate in a fully interactive space. I will go into this in detail.

Height: Price to VWAP -1 this is just a simple metric that shows when a name is trading above or below the Real Time VWAP during the trading day. If the building is up above the horizon (plate), the name is trading over VWAP. If the name is close to the plates (horizon) it is about to flip VWAP position. If the name is under the plate, it is trading below VWAP. This is a relative position comparing one name with all others.

Color: Percentage Change in Price a simple representation of if the stock is up or down on the day. Green is up, white is flat and red is down on the day. You can add or change colors to create more granularity of the view. Also note that any deep (red or green in this case) color represents an ‘alert’ that the name has passed a certain threshold. This is a relative position comparing one name with all the others.

Order: Market Capitalization the relative size of each building is comparable with other buildings on one plate. Bigger buildings have bigger market caps and smaller buildings have smaller market caps. Also notice the position of each building. They shuffle and re-order in real time to push the bigger ones to one corner and the smaller ones to another corner. This is like having a quote screen with 1500 names constantly resorting for what you want to look for.

Now click on a name that catches your eye and what happens?

Since the space is interactive, you pull up a Bloomberg Chart when you click on a name and you now get a sense of what you are looking at. You have a last tick representation of a real time chart relative to all the other names. In the case above WAG (Walgreens Inc) was down on the day most (redder) for any name in Consumer Staples but not trading at the lowest level relative to its VWAP. Essentially it is starting to bounce a bit like the chart suggests. Since it is not Dark Red (an alert limit) the landscape is simply telling you that it is approaching that level. An Aqumin landscape view like this is built for momentum traders to help identify inflections prior to an alert. The 3D quoting space simply sets up an opportunity that would be near impossible to screen for. This makes the quote screen work for the trader since you just look at it and can sense unique action.

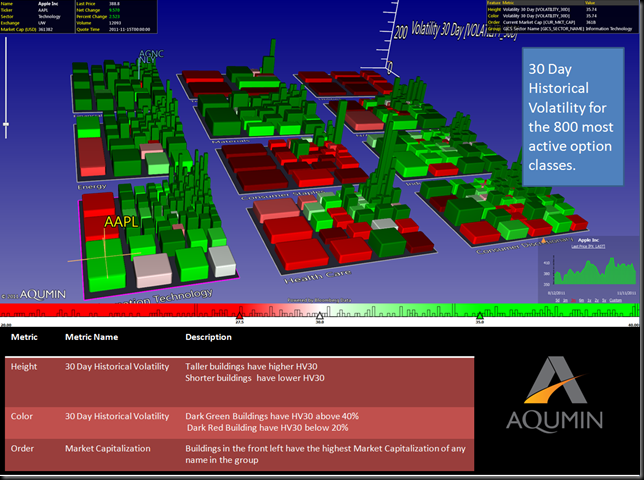

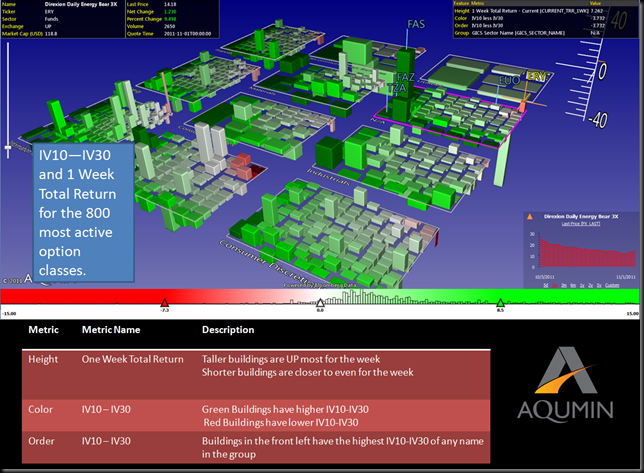

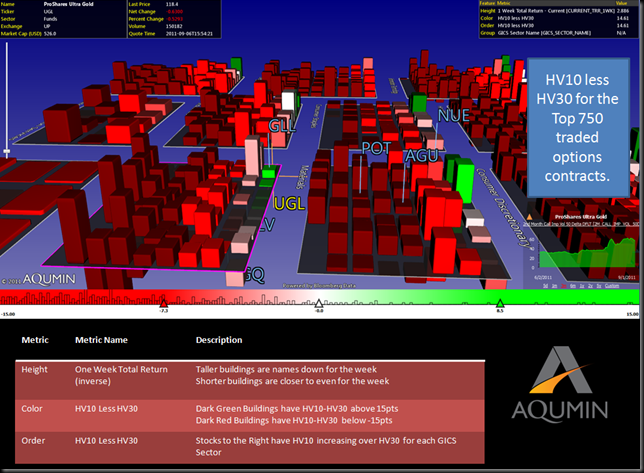

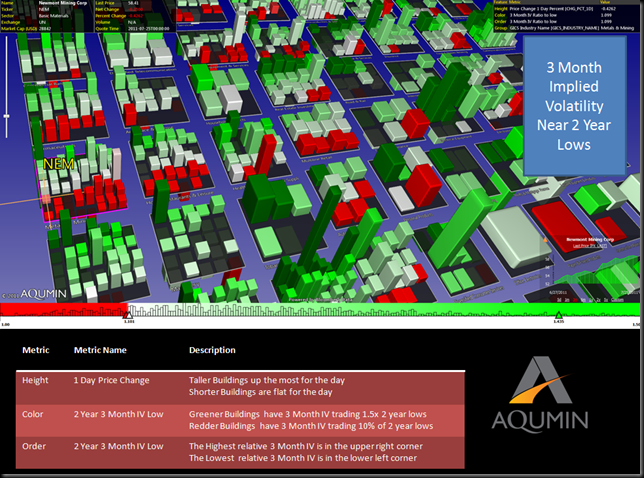

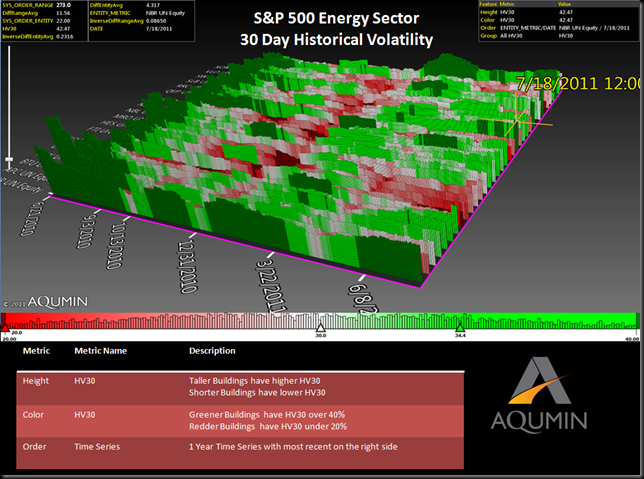

Broad quoting of volatility data

Having one view would be useful and that is how most (if not all) quote screens are set up. When you have an interactive space, you can change it on the fly and look for something else. In the sample below I want to look at a broad view of volatility data. We use the same setup for Sector plates but now we want to quote the difference in 30 Day Implied Volatility (IV30) versus the trailing 60 Day Historical Volatility (HV60). Now I use building height to show 1 week Total Return for a context layer to the volatility differentials. If a building is red, the forward IV30 is trading at a discount to the prior HV60. If a building is green, the name is trading at forward premium. So what do you do with this?

In this case of about two weeks ago the market was signaling lower volatilities moving forward based on IV30. The absolute level of current IV30 is sufficient to price the moves forward. Even with the market going south from the Euro Issues on the week of November 14th the VIX actually declined. In this case the Aqumin Landscape was a predictive indicator when looking at Broad Quoting Relationships offered in the view. The idea here is not just reading a chart but looking at many charts at once to come to conclusions about market volatility behind the broad indicators. The movement behind the movement is now possible with better a better way to view the market.

Looking for opportunities

What we have now is a new way to make decisions with the market data we already have access to. The uses moving forward are really two fold for this type of quoting technology:

1. Find the chart or name that looks interesting out of the sea of market action. That name should come to the user.

2. Use the aggregate of quotes in context to make assessments on the relative market indexes (like the VIX) or ETF’s based on the underlying group of securities that make up the larger bucket.

As traders we are always looking for edge. The high speed area of the market is in a high stakes race for technological superiority that most of us just watch. By reorganizing market data in visual space traders can wait and look at the wreckage to see if anything is worth doing. Much better to wait for opportunity then get run over in race beforehand.